straight life annuity payout

By Olivia Faucher. Ad Your life insurance policy is worth 4X more than theyre telling you.

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

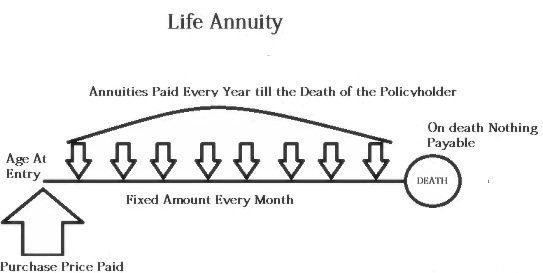

A straight life annuity sometimes called a straight life policy is a retirement incomWhat makes a straight life unique is that once the annuitant dies all payments stop and no more money or death benefits are due to the annuitant their spouse or heirs.

. Straight-life annuity without survivor benefits and joint-and-50 survivor annuity. With an SLA you are guaranteed payment until death. Ad Search For Info About How much will an annuity pay per month.

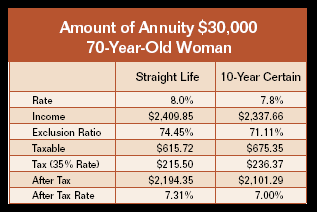

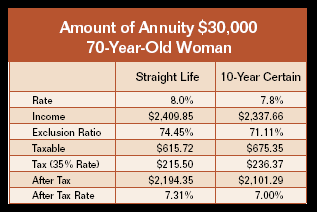

A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income. Anything else such as. Ad The Best Annuity Companies for 2022 Picked by Retirement Living Editors.

Learn about how a straight life annuity is structured the types of income payments that can be purchased with a straight life annuity and why so many retirees choose it. Unlike a 401 k or other qualified retirement plan which can run out of money a. You can sell your policy for much more than your life insurance company is telling you.

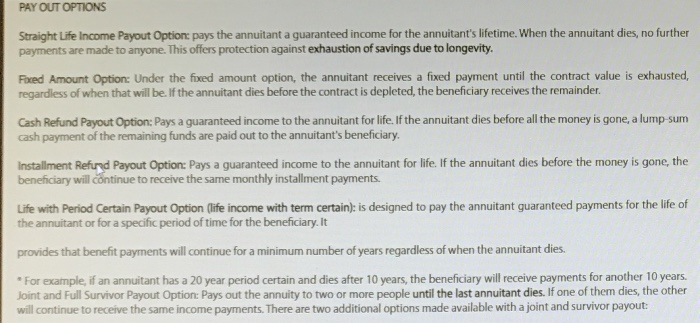

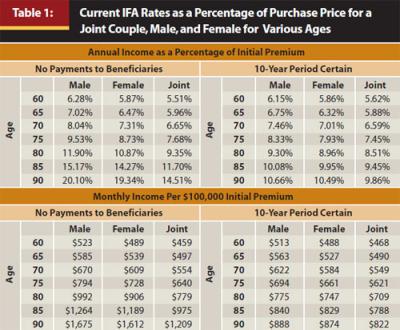

The table gives maximum guarantee amounts for the two most common forms of annuity. Straight life annuities are generally cheaper than other types of annuities as theres less risk on the insurer for the policyholder to outlive the amount that they paid into the. The payout amount will depend on how much money was invested and when they start taking payments from the SLA.

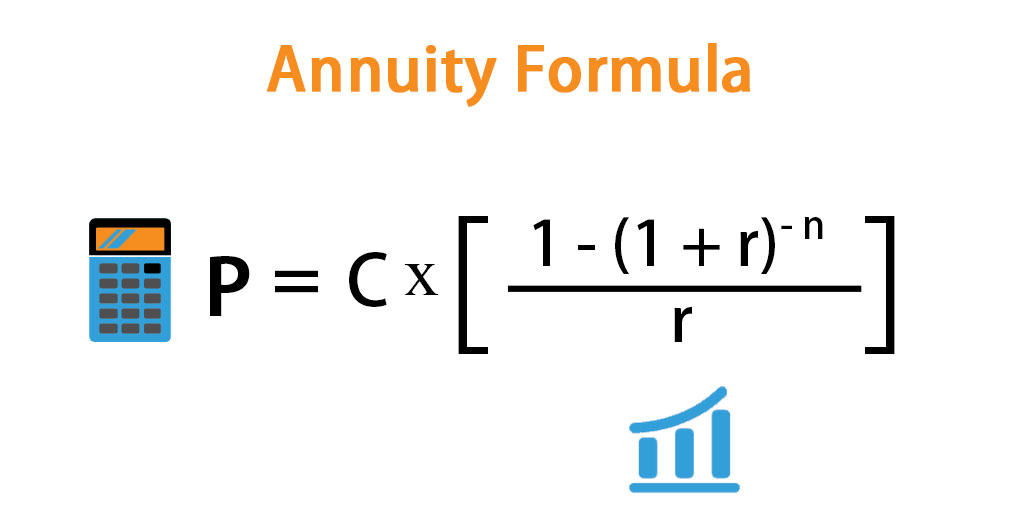

Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. A straight life annuity is tax-advantaged just as other annuities. A joint-and-survivor annuity continues to make annuity payments until the second.

In straight life payouts you receive payments until you die. A straight life annuity is a form of annuity that pays the annuitant for the rest of their life. If money is left in your annuity.

Get an estimate now. This is different from a term annuity which only pays you for a fixed amount of time. Get an estimate now.

A lifetime annuity guarantees payment of a predetermined amount for the rest of your life. Receive Monthly Pay Checks After You Retire By Purchasing An Income Annuities Today. A straight life annuity is tax-advantaged just as other annuities.

Ad Your life insurance policy is worth 4X more than theyre telling you. When you annuitize your annuity on a. Like other annuities a straight life annuity guarantees a stream of income for a set amount of time.

Another term for this option is life-only or single life annuity. Ad Explore The Fixed And Variable Annuity Options In TIAA Retirement Plans. Ad Help Fund Retirement Goals with an Annuity From New York Life.

If you are considering investing in an annuity these companies top our list. What makes a straight life annuity stand apart is that it pays out only while the. The most common life payout option is called straight life.

Browse Get Results Instantly. You can sell your policy for much more than your life insurance company is telling you. Ad Research Deferred Annuity Options Through Fidelity For Tax-Deferred Growth Potential.

Learn How To Turn a Portion of Your Savings Into an Income Stream Through Fidelity. Under a straight life annuity contract the annuity makes payouts on a regular basis for the remainder of the annuitants life no matter how long the. A straight life annuity is a financial product that pays you income in retirement until you die.

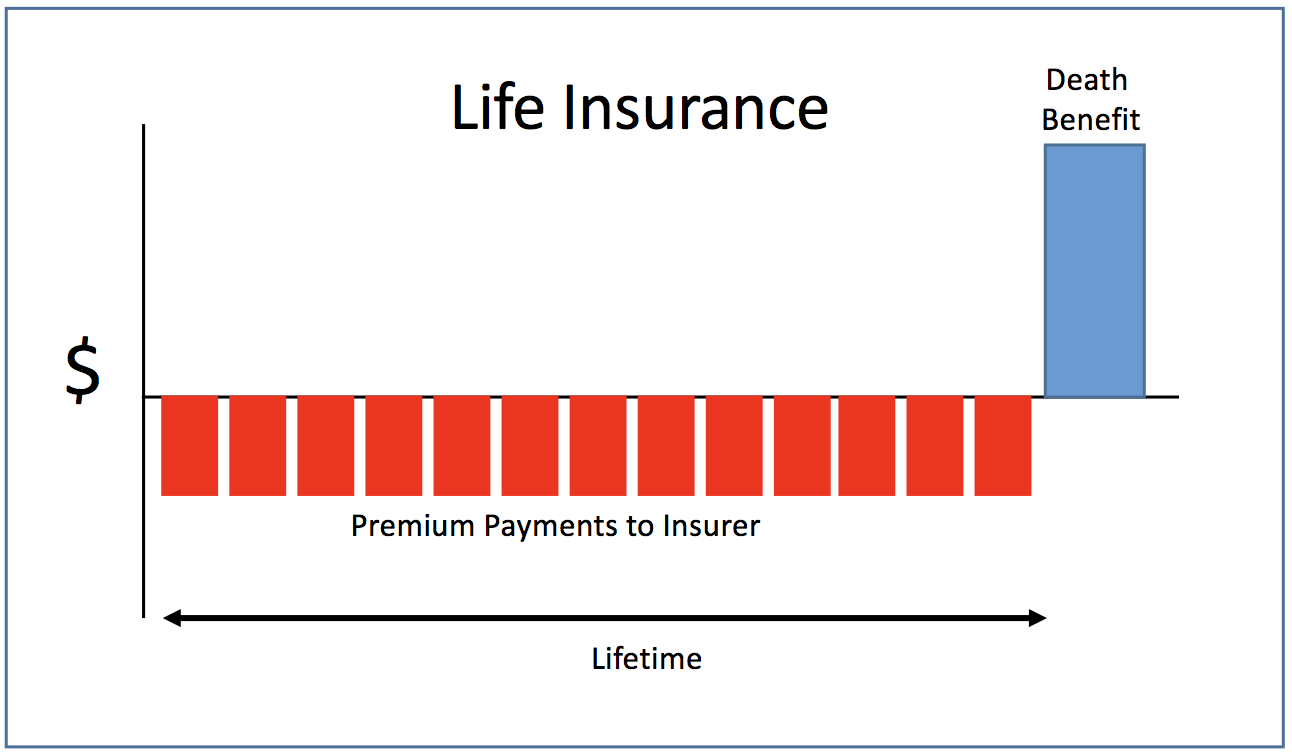

The term straight life single-premium immediate annuity refers to the same thing. Straight life annuity is really just a term for an annuitization option that annuities have. Straight life annuities do not include a death.

A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Straight life annuities do not have an expiration date or time limit and often pay out.

A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income. Ad 11 Tips You Absolutely Must Know To Find The Best Annuity Plans. TIAA Offers Personal Annuities And Annuities Through Your Employer.

This is a straight life annuity that starts paying you back as soon as you acquire it. This has the effect of making the straight life annuity less expensive tha See more. A retirement plan will offer other annuity choices besides the straight life option.

When you die the payments stop.

Income Annuities Immediate And Deferred Seeking Alpha

What Is A Straight Life Annuity Everything You Need To Know

Annuity Calculator And Its Basics Insurance Noon

What Is A Straight Life Annuity Paradigmlife Net Blog

Straight Life Annuity Explained In Simple Terms Due

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Examining The Benefits Of Immediate Fixed Annuities In Today S Low Rate Climate Financial Planning Association

Are Gifts Annuities Beyond Compare Understanding Commercial Versus Charitable Gift Annuities Sharpe Group

Do You Get Your Principal Back From An Annuity It Depends Approach Financial

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

What Is A Straight Life Retirement Annuity

What Are Annuities Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Understanding Options In Annuity Purchases

Personal Finance Deciding How To Cash In An Annuity The New York Times